I wrote this post in a fit of frustration with my day job after a particularly trying week. Auditing is a rather thankless profession. Most accountants only deal with the big “financial statement close process” of going from trial balance to full blown financial statements once a year (twice if they work for a listed company). Auditors deal with it every single day, and some days are definitely not as good as others.

Last month, I received a Facebook message from someone who stumbled across this post. It seems that this frustration is universal, even in Europe:

From Viktor S. on March 1 at 9:13 AM:

Hi, Deborah!

I found in Internet your wonderful story “Auditing for Dummies: Day in the Life of an External Auditor” and just wanted to say thanks to you for writing it!

I have never thought to find such a beautiful story about auditor’s life in other countries, cause I expected and hoped, that there are some differences in working style and working conditions between CEE Europe and other world! It’s sad to see now, that you have the same situation. I’m working as an external auditor in Big Four and all these beautiful things, which you mentioned (a typical trial balance, not nicely formatted and with errors in it, terrible clients, boring testing, time pressure, dreaming about work and etc.) are common things for us. The main part of these people, which are working and are hated by clients as auditors for many years, will laugh after reading of this funny story about their life and then return to their work instead to do something more creative. People are strange, and you are absolutely right, when you are asking: “Why do people pay us money to do something that they don’t want us to be there doing?” Thanks a lot for this story!

Fellow auditors, I feel your pain. For those of you who are more fortunate (i.e. NOT any auditor), I hope this gives you a better understanding of what it is we do and why we are not your enemy. We’re just trying to do our job too.

Update (4 Oct 2010): If you like this post, you might like a song I wrote about the “Audit Busy Season“.

Originally posted on Sat, 25 April 2009 at 01:00 while listening to “You Got It Bad” by Usher and feeling So Over It.

I never want to see another set of financials again but too bad for me because that’s not gonna happen!

I have reviewed 13 sets of financials this week and sent each set back an average of 7 times. That means I have looked at them – in detail – 91 times in total. 91 times. 91 TIMES!!!

I have woken up three times this week dreaming about work. I have also dreamed about other stuff, with my work-crazed brain mentally processing all my thoughts and dream sequences. It has been overlaying my dreams with narration in Times New Roman 11-point font and then started taking a mental green pen to said narration.

I feel like people don’t really have an understanding of what I do at work and its flow on effects which cause me no end of incredible frustration and working lots of stupid hours. What is it external auditors do? Why do people pay us money to do something that they don’t want us to be there doing?

Those are questions that are totally textbook and don’t really help to convey the picture of my typical work day so I’m not going to address those now. Rather, let me illustrate what I do at work. This is the stuff that no one really tells you about during the massive recruitment drive run by accounting firms everywhere. Nope, they only tell you about the high level, interesting parts. They don’t tell you about the daily grind that is the life of an external auditor. Certainly, I had absolutely no idea that this is what I would be doing for 4 years when I started.

Day in the Life of an External Audit Senior

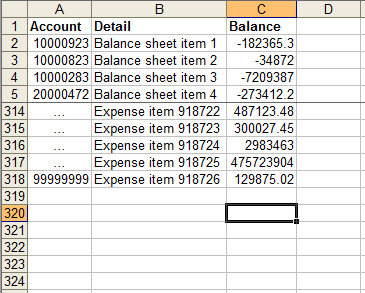

At every client, we start out with requesting this:

Actually, the whole thing starts a whole lot earlier and involves me talking to a lot of people, drawing flow charts and understanding how all the numbers get put into the trial balance. That’s the interesting part where you get to learn about the client and talk about interesting things like fraud risk and business risk and their strategic plans. After you do all that research, and you come up with your risk assessment and your audit approach, it’s back to boring testing:

During the audit fieldwork – for which your allocated time is usually between 2 to 5 days less than what you actually need and what’s physically possible, you hardly ever have the right mix of staff AND at any given point in time you can be juggling up to 5 other clients – you usually end up with a lot of problems:

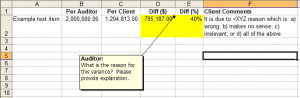

One way or another, you/the client will explain away the differences, or you argue about it and make the client post an audit adjustment to fix it. Sometimes, you can have many audit differences. I once had a client where we had close to 50 audit differences. Apparently, in China, it is very common for audit differences to number in the hundreds. *shudder* After all the adjustments are finalised, we’re happy with the trial balance:

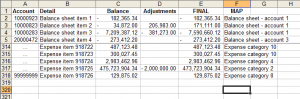

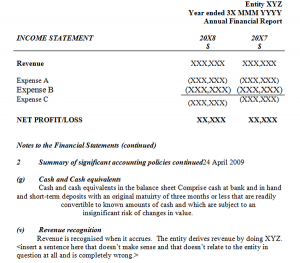

The client then uses the mapping of the final trial balance to prepare their draft financial statements. Sometimes, for small clients who don’t really know what they’re doing, we’ll do this for them as well. Some clients are really good at this step. Most clients…are…terrible.

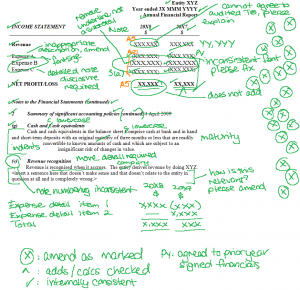

I get them and I review them in detail, meaning I add every number in the financials, I check every calculation, I match every number to supporting documentation or back to stuff we’ve audited during the fieldwork and I read every word to make sure it makes sense. I check for formatting errors and inconsistencies in how the financials have been presented. I also complete a variety of insanely long checklists to make sure they’ve included everything they’re supposed to. Generally, it’s about 3 different checklists, 2 of which are about 25 pages long each and 1 which is variable and is generally about 60-100 pages long. As a result, the financials go back to the client looking like this:

In a perfect world, I do this once, the client fixes everything, sends it back, I check that they’ve fixed everything and it’s all fine, and it gets printed and signed off and everything is done.

In the real world, this goes back and forth. Multiple times. In the case of this week, AN AVERAGE OF 7 TIMES PER SET OF FINANCIALS AND OH FOR THE LOVE OF SANITY I HAVE LOOKED AT THESE ALMOST A HUNDRED TIMES AND THEY’RE ***STILL WRONG*** BECAUSE THINGS ARE ***CHANGING INEXPLICABLY BETWEEN VERSIONS*** WHY OH WHY OH WHY OH WHY OH WHY-

Moral of the Story

Ahem.

So I hope after all that you now have a better understanding of what it is external auditors do. For those of you going into commercial practice, please, please, PLEASE do you and me a huge favour and CHECK YOUR OWN WORK before you send it to me and make sure it’s right and you’ve done what I’ve asked you to do. Not only will this save you (and me) a whole bunch of late nights in the office and some very unpleasant conversations, it will probably also save you several thousand dollars in audit fee overruns.

Because we WILL bill you for your incompetence and screw ups when it costs us time and effort.